utility for service tax return

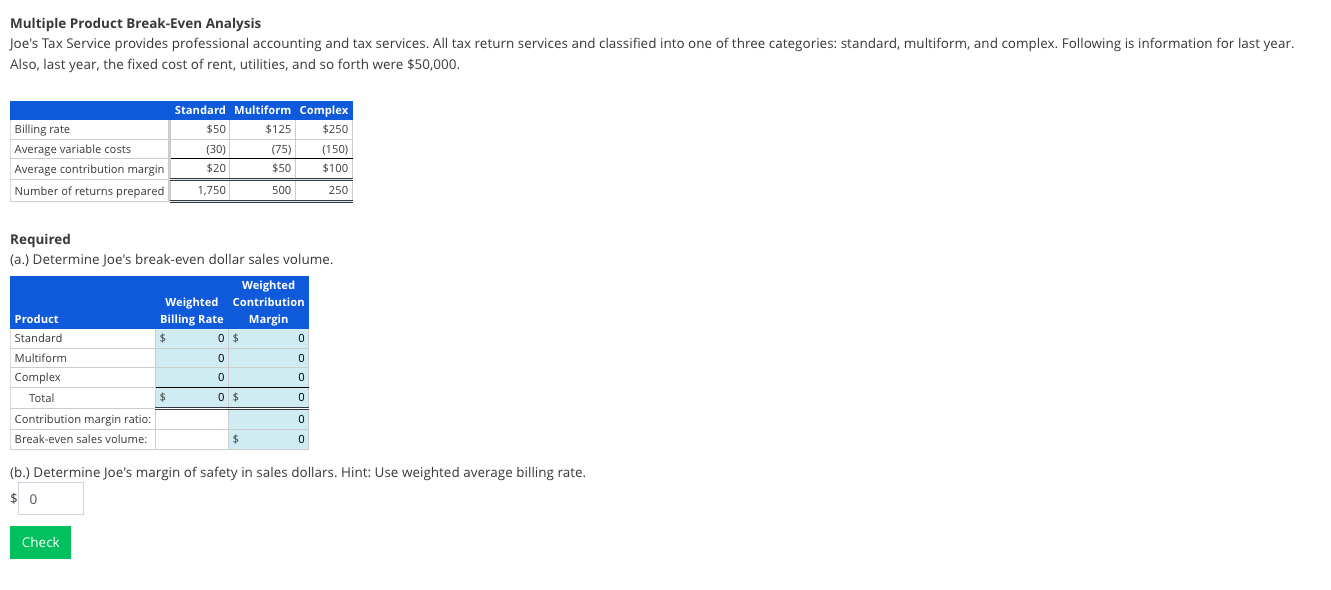

Current Utility Tax Forms 2021 Utility Tax Forms. The utility service use tax is an excise tax levied on the storage use or other consumption of electricity domestic water natural gas telegraph and telephone services in the State of.

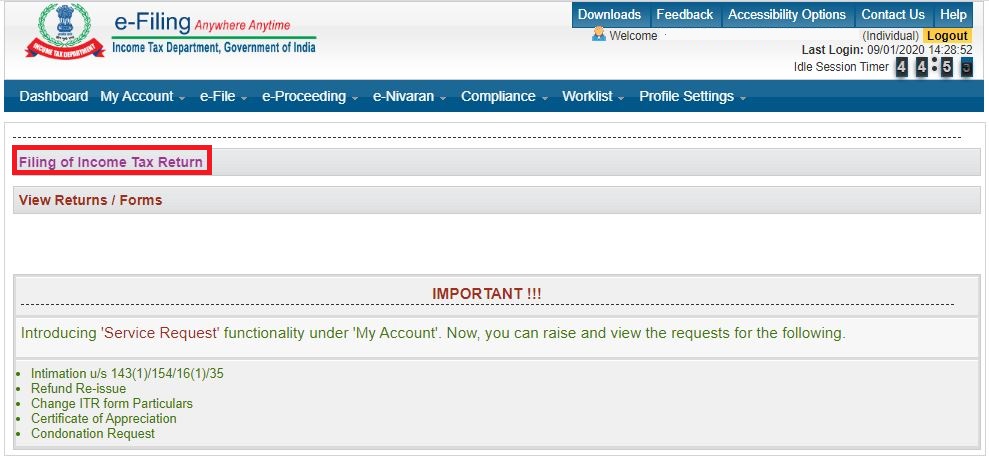

How To File Service Tax Return Online Procedure Myonlineca

Below you can get an idea about how to edit and complete a Nyc-Uxs Utilities Tax Return For Utility.

. Business Taxes and Licenses. A Quick Guide to Editing The Nyc-Uxs Utilities Tax Return For Utility Services Vendors. The basic utility tax rate is 235 of gross income or gross operating income.

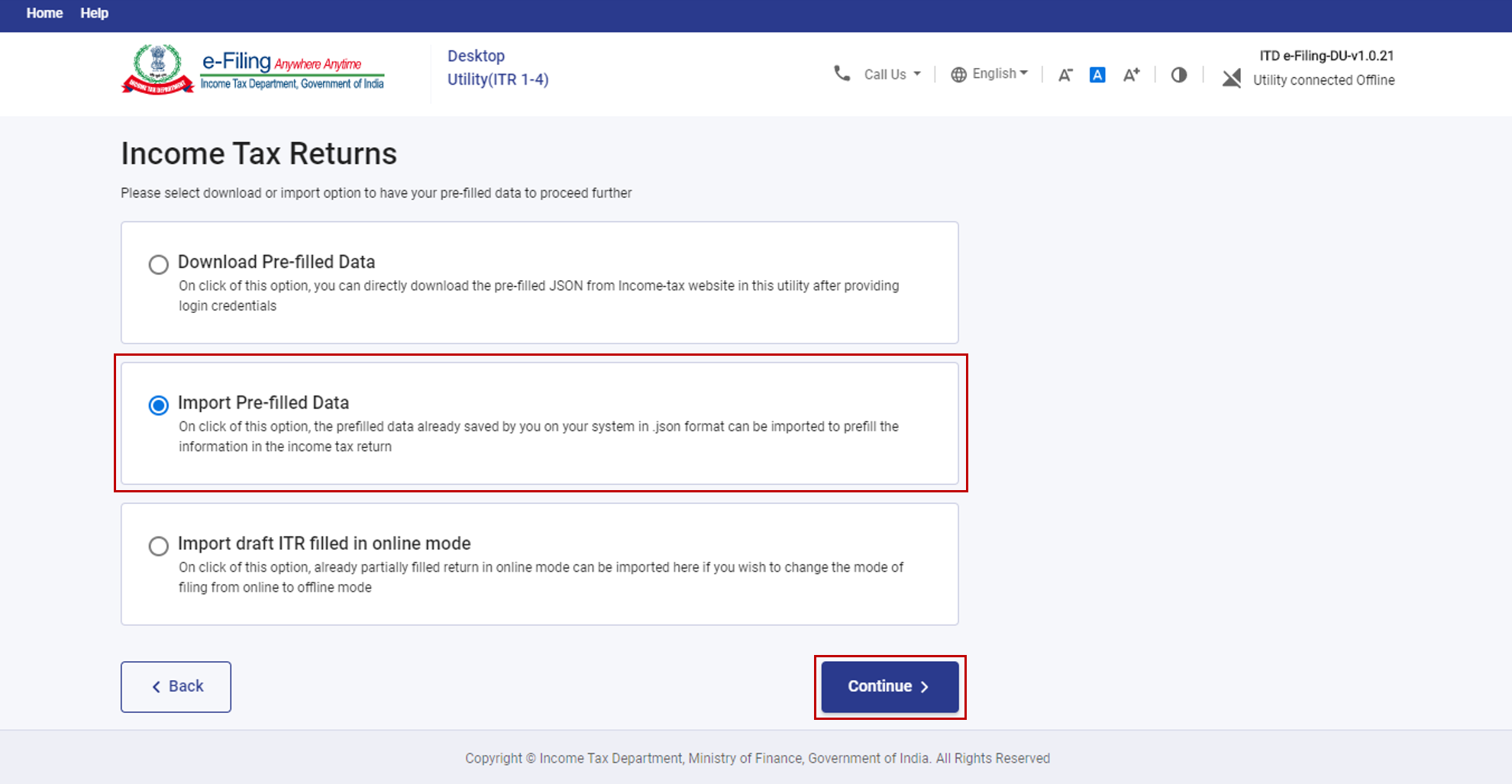

Urban transportation and watercraft vessels under 65 feet in length. Business Taxes Information about business taxes. Common Offline Utility ITR 1 to ITR 4 Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23.

Telegraph companies distribution of natural gas and collection of sewerage. You received a 5447C letter and can verify your identity online. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page.

Make sure all preprinted information is correct for the tax period you are filing. Documents on this page are provided in pdf format. Neal D-MA released the following statement after the latest decision of the United States.

You must file a monthly return even if no tax is owed. NYC-95UTX - Claim for REAP Credit Applied to the Utility Tax. Omnibus operators subject to nys department of public service supervision.

Please sign and date each return. Public utility service tax excise tax return form city of bridgeport z finance department p. If you received a.

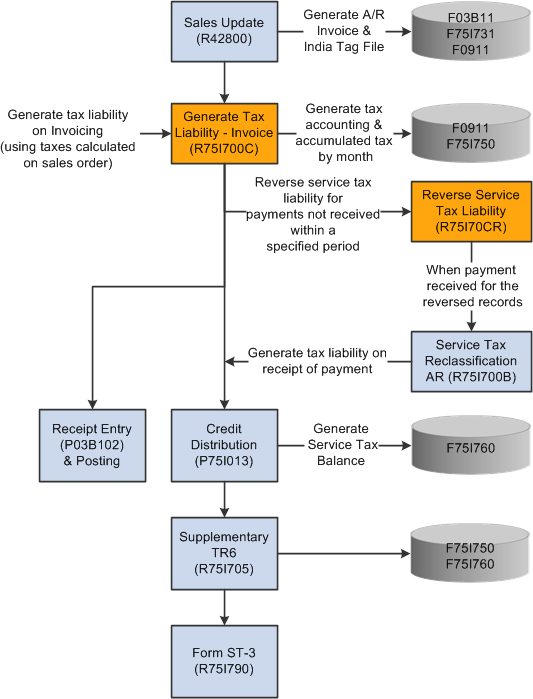

Utilities for e-filing Service Tax Returns ST-3 ST3C for the period October 2016-March 2017 are now available in both offline and online version. The sole responsibility of the Florida. The service tax return is required to be filed by any person liable to pay the.

File a Damage Claim. Who Must Use the Identity and Tax Return Verification Service. The person liable to pay Service Tax should himself assess the Tax due on the Services provided.

Municipal public service tax MPST is locally imposed and administered by municipalities and charter counties under Chapter 166 Florida Statutes. The following paragraphs outline the filing cycle based upon the amount. An IRS representative directed you to use it.

SPRINGFIELD MAToday House Ways and Means Committee Chairman Richard E. Download ST3 Return Excel Utility V16. The Service Tax return is required to be filed by any person liable to pay the Service Tax.

Utility services use tax due for the period multiply line 4 by the tax rate of 14 percent 0014. Utility service providers must file a return and remit the full amount of tax collected to the City. NYC-98UTX - Claim for.

Former President Donald Trump has asked the US Supreme Court to block a congressional committee from getting years of his tax. However different rates apply to bus companies and railroads as shown below. Download ST3 Return Excel.

Learn how to pay your business taxes or apply for a business license in Seattle.

Offline Utility For Itrs User Manual Income Tax Department

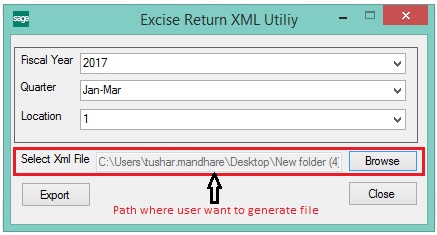

Offline Excel Utility Procedure For Excise Return Excise Return Proc

Project On Service Tax Submitted By Submitted To Name Roll No Reg No Ppt Download

E Return Filing Of Central Excise And Service Tax Returns Make Easy With Xml Utility In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

Goods Service Tax Cbic Government Of India Aces

Solution To Problems Of New Income Tax Portal

Refuting Marginal Utility Case For Progressive Taxation National Review

Income Tax Return Preparation Utilities Saran Management Services Pvt Ltd In Trichy India

Gsoftnet St 3 Q2 Return Software Free Download And E Return Steps

E Filing Of Service Tax Return For Apr 14 To Sep 14 Enabled Due Date 25 10 14 Simple Tax India

Goods Service Tax Wxpert4u Deals In All Services

How To Disclose Service Tax Advance In St 3 Return Aviratshiksha

Malaysia Sst Sales And Service Tax A Complete Guide

Service Tax Return St 3 Excel Utility Oct 2016 Mar 2017

Service Tax Return Due Date Penalty For Late Filing For Period April 16 To Sep 16 Simple Tax India